CT Bond Ratings

Similar to an individual's credit score, the State of Connecticut's bond ratings (sometimes referred to as credit ratings) are indicators of the State's ability to pay back its debts. Connecticut's bond ratings exist to provide potential investors interested in purchasing bonds from the State with context about Connecticut's fiscal health as well as an analysis of the relative risk associated with purchasing bonds issued by the State.

Moody's Investors Service, Fitch Ratings, and Standard & Poor’s (S&P) are the three primary credit rating agencies that provide bond ratings. These rating agencies are typically paid by the entity that is seeking a credit rating for itself or for one of its debt issues.

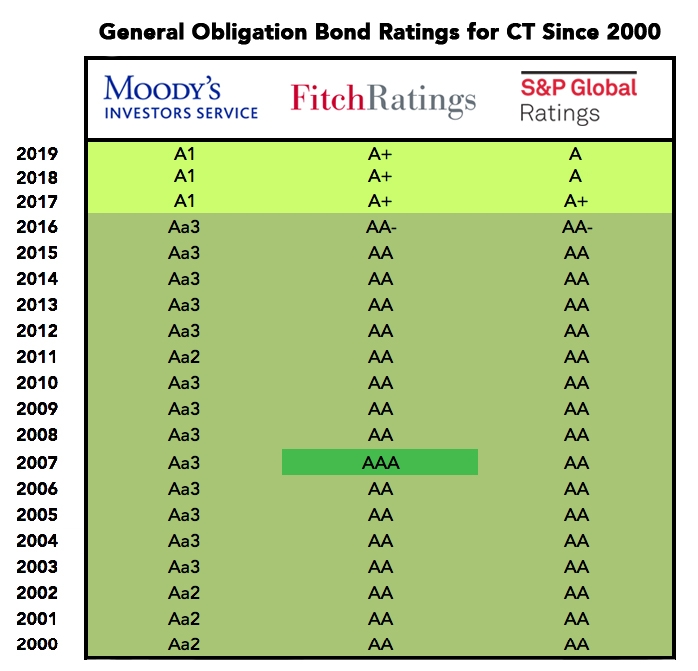

While Connecticut issues different types of bonds (general obligation, special tax obligation, Clean Water Fund, and UCONN general obligation) and is rated on each of them, this section only focuses on the State's general obligation bond ratings. General obligation bonds are secured by the State's power to tax. The State pledges its full faith and credit for payment of principal and interest to investors.

Connecticut's bond ratings have a significant impact on the interest the State must pay on the bonds it issues. The higher the State's ratings for its general obligation bonds, the lower the yield (the return an investor realizes on a bond) a bond can be issued at, therefore lowering interest costs for the State. Essentially, the higher Connecticut's bond ratings are, the less risky it is for investors to purchase the bonds the State issues. The less risky a bond is, the less Connecticut has to pay in interest to those who purchase the bond, as it is considered a safer investment.

While Connecticut's general obligation bond ratings remained relatively consistent from 2000-2015, from 2016-2018, the State's general obligation bond ratings were downgraded six times. In May 2017 alone, each of the three major credit rating agencies downgraded the State's general obligation bond ratings citing "eroding state income tax receipts, the impending depletion of the state budget reserve, and huge unfunded liabilities expected to drive public-sector retirement benefit costs up for the next 15 to 20 years."

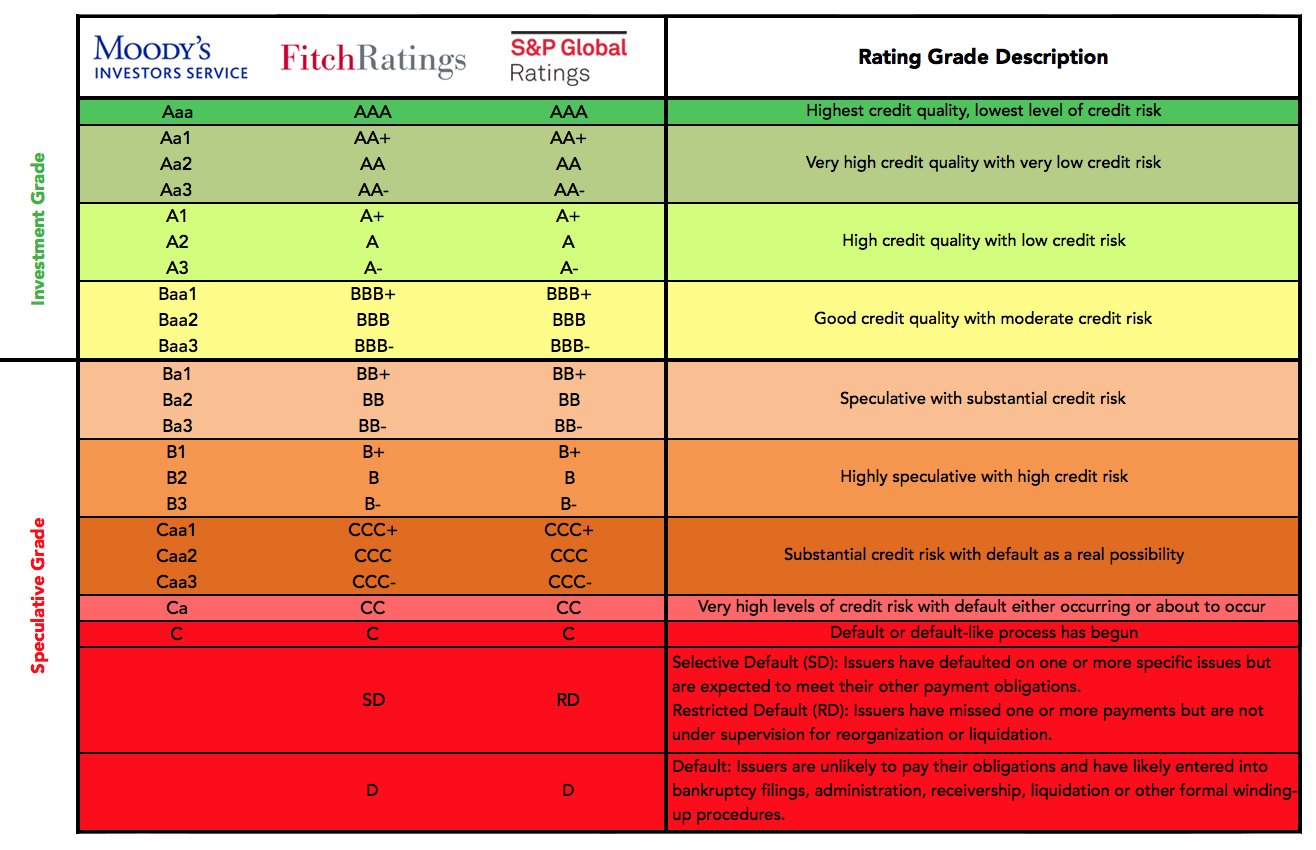

Rating Scales

Each credit rating agency has its own scale for bond ratings that outlines the credit quality and risk associated with a certain grade. Below is a table comparing the scales for the three major credit rating agencies. (Click the image for a larger view of the table)