2017 SEBAC Agreements

In response to the growing unfunded liabilities and increasing state contributions associated with the State Employees Retirement System (SERS), the administration of Governor Dannel Malloy and the State Employees Bargaining Agent Coalition (SEBAC) reached two agreements in 2017 aimed at addressing the State’s long-term obligations to SERS and its members. Both agreements were approved by the Connecticut General Assembly in February 2017 and July 2017, respectively.

February 2017 SEBAC Agreement

The first agreement between the Malloy administration and SEBAC spread out the State’s payments to SERS by shifting at least $13.8 billion in annual contributions to future years. By modifying the funding calculation and schedule for the State to pay off its unfunded liabilities related to SERS over time, the agreement allowed Connecticut to reduce its projected annual contributions over the next 15 years and avoid a potential $4.48 billion contribution to SERS in fiscal year 2032.

Prior to the SEBAC agreement approved by the General Assembly in February 2017, the State’s projected annual contributions to SERS would have risen precipitously — peaking in fiscal year 2032 — before dropping to levels as low as $438 million in fiscal year 2034. However, under the agreement, the State’s contribution to SERS would rise at a slower pace before stabilizing at a projected annual contribution of roughly $2.5 billion from fiscal year 2023 to fiscal year 2032. After peaking in fiscal year 2032 at $2.55 billion, the State’s projected annual contribution would decline to approximately $2 billion and remain near that level through fiscal year 2047.

Along with avoiding the significant spike in contributions to SERS by spreading the State’s payments out further over time, the February 2017 SEBAC agreement reduced SERS’ annual assumed rate of return from 8.0 percent to 6.9 percent. However, the assumed rate of 6.9 percent is still higher than SERS’ average actual rate of return since fiscal year 2001 (5.4 percent) as well as the three or four percent assumed rate that many in academia and the financial sector argue is more realistic since the Great Recession. As a result, should SERS’ actual rates of return fall short of its assumed rate, the State’s projected annual contribution to SERS could increase in order to make up the difference between the two rates and prevent greater expansion of SERS’ unfunded liabilities.

Finally, it is important to note that the February 2017 SEBAC agreement did not affect benefits for current or future state employee retirees, nor did it alter what state employees must contribute themselves to SERS.

July 2017 SEBAC Agreement

Unlike the February 2017 agreement, the second agreement between the Malloy administration and SEBAC was a concessions deal — meaning roughly 46,000 current unionized state employees would see certain changes to their benefits in order to reduce the State’s projected costs and obligations.

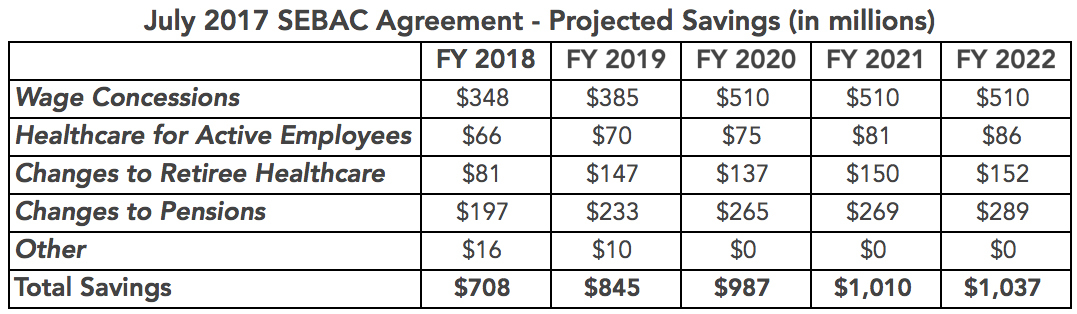

According to an actuarial analysis, the concessions deal is projected to save the State $1.57 billion over the next two fiscal years ($701 million in fiscal year 2018 and $869 million in fiscal year 2019), $4.8 billion over the first five years of the agreement, and more than $24 billion over the next 20 years. Additionally, under the concessions deal, the State’s projected annual contributions to SERS would decrease by an average of $383.8 million or 17.7 percent, peaking in fiscal year 2024 at approximately $2.22 billion ($328 million less than the projected peak State contribution under the February 2017 SEBAC agreement).

Wage Concessions

Nearly half ($769 million) of the projected savings over the next two fiscal years are the result of wage freezes. Under the concessions deal, state employee wages are frozen for fiscal years 2018 and 2019 and employees (many of whom worked during fiscal year 2017 under contracts that expired in June 2016) forfeit any retroactive pay hike. Additionally, the concessions deal requires state employees to take three furlough days in fiscal year 2018 (saving the State a projected $36 million) but guarantees 3.5 percent pay raises to state workers in fiscal years 2020 and 2021.

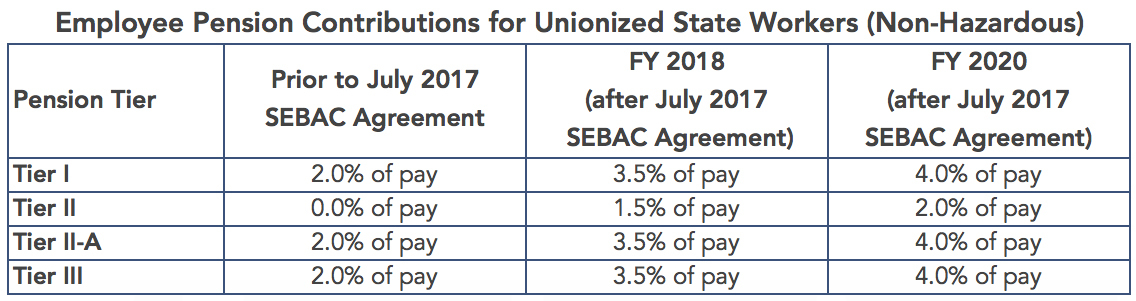

Increased Employee Contributions

Along with wage concessions, the July 2017 SEBAC agreement increases employee pension contributions by two percent (1.5 percent in fiscal year 2018 and 0.5 percent in fiscal year 2020). Prior to the agreement, roughly 25 percent of Connecticut’s state employees did not make any contributions to their pension benefits, and for those who did make contributions, most contribute two percent of their pay — well below the national average of seven percent for employee contributions.

New Benefit Tier

The July 2017 SEBAC agreement also creates a new hybrid benefit tier (Tier IV) for new employees that combines SERS’ traditional pension benefit with a 401(k)-style defined contribution plan. Under the new tier, state employees would be required to contribute at least one percent of their pay to their retirement account with the State matching one percent. Additionally, under the new tier, only 60 percent of an employee’s overtime earnings can be applied when calculating the employee’s retirement benefit. For all other tiers, employees’ full overtime earnings are applied when calculating their pension benefits.

Healthcare Costs

The concessions deal, according to the actuarial analysis, also decreases the State’s long-term, unfunded liabilities related to retiree healthcare from $20.9 billion to $15.6 billion — a reduction of approximately 25 percent. This reduction is achieved by moving all retirees to a Medicare Advantage Plan (a move that is projected to save $218 million over fiscal years 2018 and 2019); increasing premium costs and co-pays for current state employees; and requiring state employees who retire after June 30, 2022 to share in the costs of Medicare Part B, which the State currently pays the full cost of.

What Union Members Received in Exchange

In exchange for these concessions, the State extended the benefits contract for unionized state employees by five years. Previously set to expire in 2022, the July 2017 SEBAC agreement extends the contract through June 30, 2027 — a move that opponents of the agreement have claimed is too generous. For bargaining units that voted in favor of the wage-related concessions contained in the agreement, their members are exempted from layoffs through June 30, 2021. Bargaining units representing state police and assistant attorneys general were the only units to not approve the wage concessions and therefore are not protected from layoffs.

Approval of Agreement

According to SEBAC, 85 percent of votes cast by unionized state employees were in favor of the wage freezes outlined in the concessions deal, while 83 percent of votes cast were in favor of increased employee contributions for pensions and healthcare coverage. The agreement was approved by the House of Representatives on July 24 by 78-72 vote and then by the Senate on July 31 with Lieutenant Governor Nancy Wyman breaking an 18-18 tie to give the agreement final approval.