Budget Process

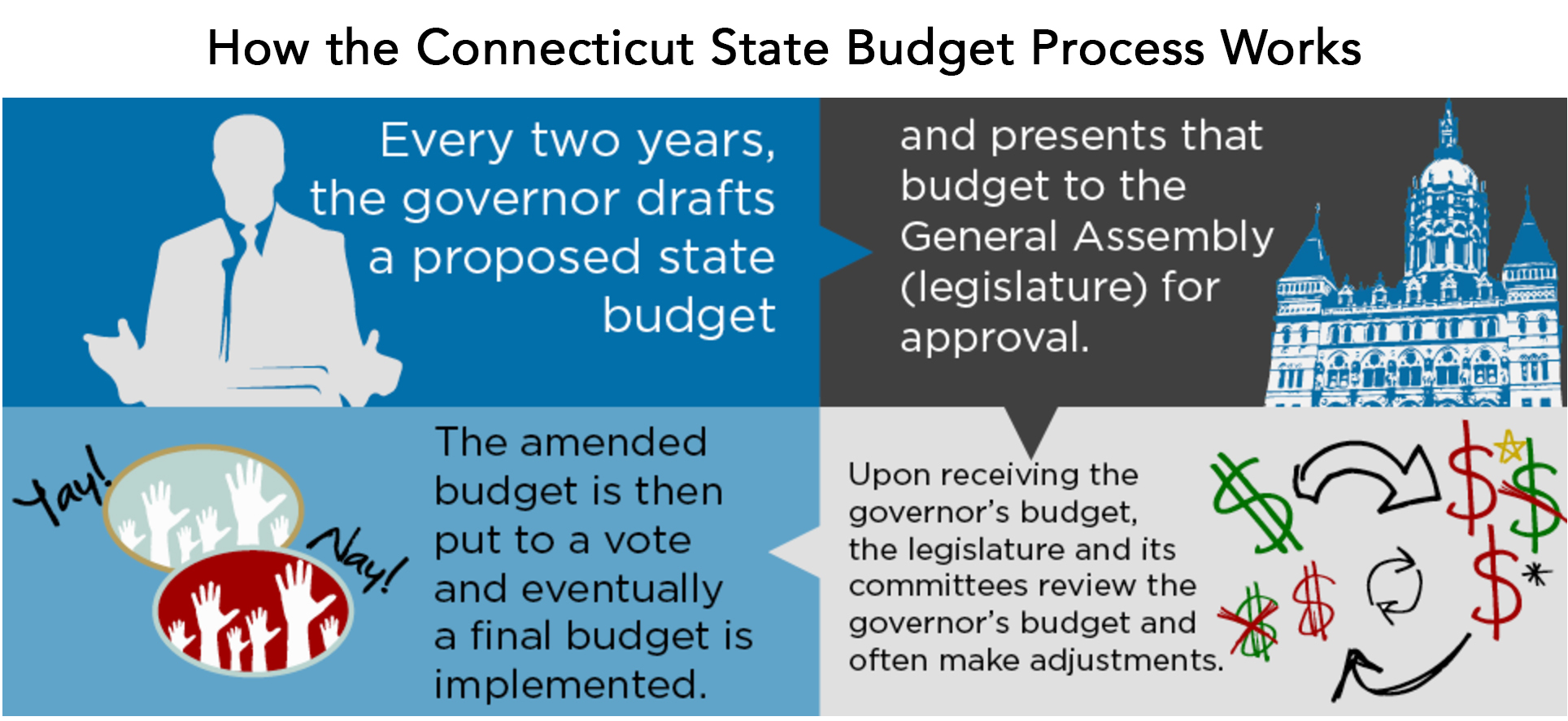

The State of Connecticut has a biennial (two-year) budget process. In February of odd-numbered years, the governor of Connecticut presents the General Assembly with a recommended budget for the next two years. In even-numbered years, the governor reports to the General Assembly on the status of the budget and makes recommendations for revisions and adjustments to the budget as they are needed. Connecticut's fiscal year runs from July 1 through June 30. For example, fiscal year 2021 began on July 1, 2020 and will end on June 30, 2021.

The General Assembly, which is responsible for authorizing spending and raising revenue, then reviews the governor’s proposed budget. This review begins with the Appropriations and Finance, Revenue and Bonding Committees holding public hearings on spending and revenues, respectively.

Next, the Appropriations Committee develops a revised budget, which is then passed out of the committee (usually in April). During the same time period, the Finance, Revenue and Bonding Committee meets separately to determine any revenue changes and passes a revenue package out of the committee (also usually in late April).

After the Appropriations Committee approves a budget and the Finance, Revenue and Bonding Committee approves a tax package, leadership from the House of Representatives and the Senate, typically in consultation with the Office of the Governor and the Office of Policy and Management, work to develop a final budget bill. During this time, any number of changes may be made to the budget through bipartisan negotiations.

The budget bill then goes before the House and Senate. Each chamber must pass the same exact version of the budget in order for the bill to move on to the next step in the process. In addition to the budget, which outlines the amount of spending and revenue, the General Assembly must pass enabling legislation called implementer bills that contain the policy provisions that put the budget into effect.

After being passed by both chambers, the legislature’s final budget must then be signed into law by the governor, before June 30 — the end of the fiscal year. However, the governor has the constitutional power to veto the budget in full if he/she does not agree with it, and may veto specific items in the budget through what are referred to as “line-item” vetoes. A passed budget may also go into effect without the governor's signature if the governor does not sign or veto the budget within five days of receiving the bill from the legislature.

Click to view previous state budgets and to learn more about Connecticut's budget process